Nigeria News

Boabab Bank Begins Disbursing N16B to Customers without Collateral- See how to Apply

Boabab Bank is one of the leading Micro Finance Bank in Nigeria with head office in 360, Murtala Muhammed Way, Yaba, Lagos, Nigeria.

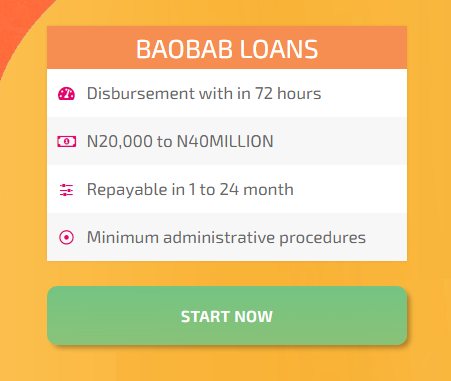

The bank has started the disbursement of N16 Billion Naira loan to applicants who are interested in the offer. Kindly take a look at the following frequently asked questions.

TRENDING NOW

- ACCESS Bank Begins Disbursement of N50B Interest-Free Loan- Apply

- Apply as an Accountant at H-Medix Job, Abuja

- CBN COVID-19 Loan: Received Alert but not Credited? (Here is what you should do)

- Always Ibom State Water Company Recruitment 2020, See how to apply

- Apply for Enugu State Civil Service Commission Recruitment 2020

HOW MUCH CAN I BORROW?

Our minimum loan amount is N20,000 and a Maximum amount of N50,000,000. Both depend on the borrower’s repayment capacity assessed based on verifiable business inventory and other criteria.

WHAT TYPE OF LOAN DO YOU OFFER?

What we offer are business loans for businesses that are already in existence/operation, and housing/house improvement loans.

WHAT ARE YOUR LOAN REQUIREMENTS?

To access our loan facility, you must have a business, the location must be within our bank’s lending area (Lagos state, Oyo state and Ogun state) and it must have been in existence within a specific period.

HOW LONG DOES IT TAKE TO GET A LOAN?

It doesn’t take longer than it ought to as long as the necessary requirements are adequately met (less than 3 working days).

WHAT IS YOUR INTEREST RATE?

Our interest rate differs depending on the loan amount. However, it is very competitive.

DO I NEED TO OPEN AN ACCOUNT BEFORE I CAN GET A LOAN?

No fee or mandatory account opening is required before you can get a loan from us.

How can I get a loan from Boabab Microfinance bank in Nigeria?

- “The following are simple steps to getting a loan from Boabab microfinance banks in Nigeria.

- Have A Genuine Reason Or Project For The Loan.

- Microfinance banks will never loan you money for frivolities. …

Document It. - Open An Account With The Bank

- Service The Account For A Period Of Time

- Present A Collateral Or Its Documents”

To apply Kindly use the link below and make sure you follow strickly to the outlined above.