Cryptocurrency

The Difference Between Last Traded, Mark, and Index Prices In The Cryptocurrency Market

The cryptocurrency markets are full of seemingly mysterious terms that can be confusing to the new investor. But there’s one particular set of different values that is particularly hard to pin down, and it involves last traded mark and index prices. Let’s take a look at how each of these three values applies to cryptocurrency trading, and how they can affect your portfolio.

What is the last traded price in cryptocurrency markets

In cryptocurrency markets, the last traded price is synonymous with the market price. It is the price at which the last transaction was made on a crypto asset exchange. The last traded price can be easily found on a crypto chart and will always be displayed in green.

What is the function of the last traded price in crypto

The last traded price is a reflection of the most recent transaction executed on an exchange or through an OTC marketplace. If you want to know what someone paid for 1 BTC at a given moment in time, then this is your number.

It can also be used to calculate other metrics like the mark price or index price. The last traded price is typically updated every few seconds by exchanges such as KuCoin and Coinbase Pro via APIs (application programming interface) based on live markets where people are trading coins for fiat currency or other cryptocurrencies like Ethereum or Litecoin.

How To Calculate Last Traded Price in crypto

A last traded price is the price at which the last transaction was made in a cryptocurrency market. It’s important to note that this price is not necessarily what you would pay for a single unit of a cryptocurrency, but rather it shows you the average price of all transactions that have occurred over some period of time (usually 24 hours).

The last traded price can be calculated by finding out how much change there has been from one minute to another and then dividing that by 60 (seconds in an hour).

What is index price in crypto?

In the cryptocurrency market, the price of a coin is known as its index price. The Index Price is the price at which you can buy or sell a cryptocurrency, it’s what you see when you go to a cryptocurrency exchange, and it’s what you see in the top right corner of CoinMarketCap.com.

The index value will almost always be higher than both bid and ask prices because it includes all trading pairs including ETH USDT that have ever been executed on a cryptocurrency exchange.

What is the function of index price in crypto?

The index price is an average of the last trade price and the mark price. The index price is not a market, but it can be used as a reference to measure the performance of a cryptocurrency. The index price allows investors and traders to compare the market performance of different cryptocurrencies by eliminating the effects of each exchange’s individual pricing rules.

The index price also gives miners a benchmark for their mining effort and allows developers to estimate the number of rewards they will receive when they release new coins. In short, index prices give users a common benchmark to use when valuing and measuring cryptocurrency performance.

How To Calculate index Prices in crypto

You can calculate the index price by first finding the price of the last trade. Once you have that, you divide it by the total number of coins in circulation. Then multiply your result by 100 to convert it into a percentage, and that’s your index price.

What is mark price in crypto?

The mark price is the price at which a crypto asset is sold. It’s used to calculate the mark price ratio and index, which are essentially indexes that rank different crypto assets by their total market capitalization.

Mark prices are usually higher than the last traded price. Sometimes they are even much higher (up to 100%) because people generally place orders to buy at a higher price and orders to sell at a lower one.

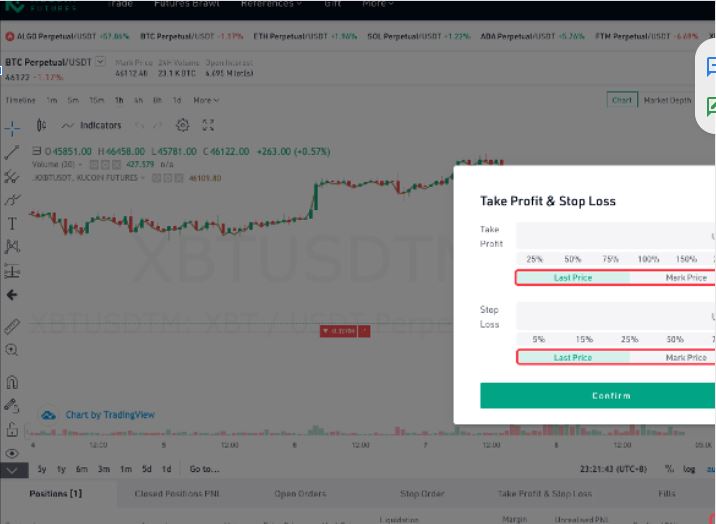

In a comparison of mark price vs last price, the mark price is a term used to refer to the price of cryptocurrencies when they are traded while the last traded price is simply the most recent price at which a trade took place.

What is the function of mark price in crypto

The mark price is often the most valuable piece of information for crypto traders. It’s the price at which you can sell or buy your cryptocurrency.

It is not based on a transaction. The mark price is also known as the “internal price” or “indicative value”, and it’s based on the order book, which reflects all buy and sell orders placed by traders with their desired prices.

The mark price is the quoted midpoint between bid and ask prices. It is usually set by market makers who are assigned by exchanges to maintain orderly markets. It is also known as the midpoint price.

How To Calculate mark Price in crypto

The mark price is calculated based on recent trades made on the exchange platform. This value reflects how much each coin was sold or purchased for in the most recent transaction made by a user on that platform. This means that if a user sells a coin at $5 and another user buys that same coin at $5, the mark price will be $5.

Relation and difference between last traded price, index price and mark price in cryptocurrency markets

The last traded price is the price at which the last trade was executed. It is also known as the ask price, or offer price when trading.

When using exchanges to buy or sell cryptocurrencies, you will see two prices for each coin: an index and a mark price. The index is an average of all prices in the market, while the mark represents all coins’ prices but excludes the highest and lowest prices.

Cryptocurrency5 days ago

Cryptocurrency5 days agoPixelverse Just Launched, and Millions Made, Dotcoin is about to Launch, Here is how to Join

Cryptocurrency5 days ago

Cryptocurrency5 days agoBinance’s Upcoming App Launch: Don’t Miss Out on This $10,000+ Airdrop

Recruitment13 hours ago

Recruitment13 hours agoLink to Apply for NNPC Recruitment 2024 – Follow this Guide to Register Successfully

Cryptocurrency4 days ago

Cryptocurrency4 days agoGet Rewarded Instantly: Renta Network Airdrop – Don’t Miss Out!

Nigeria News2 days ago

Nigeria News2 days agoTurn Clicks into Cash: Earn Up to $2 Daily with Nomis Score on Telegram – Start Now!

Cryptocurrency3 days ago

Cryptocurrency3 days agoLatest Airdrop Alert! Join Our Telegram Group and Make a Path to the Web3 Wealth

Cryptocurrency5 days ago

Cryptocurrency5 days agoCongratulations! You can Now Claim #DD Token, (You’re still Early if you are seeing this Post)

Recruitment13 hours ago

Recruitment13 hours agoHow to Successfully Apply for NNPC Recruitment Despite Website Traffic