Business

YouThrive: Apply for Access Bank N50 Billion Loan for MSMEs

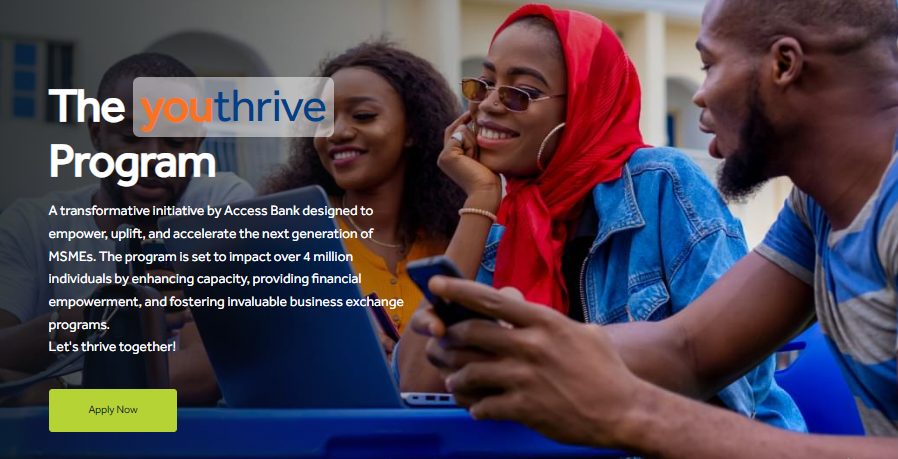

The Youthrive Program is a transformative initiative by Access Bank designed to empower, uplift, and accelerate the next generation of MSMEs.

The program is set to impact over 4 million individuals by enhancing capacity, providing financial empowerment, and fostering invaluable business exchange programs.

The 4 Stages of the Access Bank YouThrive Program

Capacity Development

Empowering the youth with skills for entrepreneurship and employability.

Business Exchange

Exceptional entrepreneurs will be sponsored by the Business Exchange Programs in the Netherlands, China, or India.

Access to Funding

Get access to finance through business grants and business loans to scale your business upon completion of the capacity development programs.

Employment

Discover employment opportunities after completing our comprehensive capacity development programs.

Application Requirements:

- Startup: A new business with less than 12 months in operation.

- Business Owner: An established business with more than 1 year in operation.

- Graduate: A tertiary institution degree holder seeking active employment or business venture.

- Non-Graduate: A young individual with a minimum of a school leaving certificate seeking skill acquisition or business venture.

How to apply:

Interested applicants should apply via https://youthrive.accessbankplc.com

FAQ

What is the primary focus of the training program for career-focused youths and entrepreneurs?

The training program is designed to empower and enhance the skills of individuals and entrepreneurs with training courses on creative industry, IT/Tech sector, entrepreneurship programs and skill acquisition trainings, equipping them for success in their respective fields.

How is the training program structured to cater to the diverse needs of participants?

The program will be delivered through a flexible approach (physical and virtual), offering diverse modules and resources to accommodate participants with various goals & aspirations, whether in entrepreneurship or in the corporate world.

How long is the duration of the training, and what are the key components covered during the program?

The training duration is structured to provide comprehensive learning opportunities. Key components include skill development, entrepreneurship training, and career-focused modules.

How can interested individuals apply for the training program, and what is the selection process like?

Information on applying for the training program is available on our website. The selection process begins once you have successfully applied. Applications are reviewed to ensure the program is a good fit for the candidates, and shortlisted applicants are contacted with details of the training schedule.

Is opening an Access Bank account a requirement for this program?

An Access Bank account is compulsory to access select program benefits including trainings, loan disbursements, grant payments and other offerings.

Loans

How are the loans and grants structured, and what are the eligibility criteria for applicants?

The financial support options are tailored to the needs of the participants. Grant eligibility would require successful completion of the training and a viable business plan. Affordable loan options are available to registered and unregistered MSMEs subject to terms and conditions.

Can I use my existing current or savings account to access the loan opportunity?

Only an existing business current account can be used. However, you can easily open a business current account by clicking on onboarding.accessbankplc.com before submitting your application.

What type of business account can I open?

The DBALite is a cost-effective business current account that is specifically designed for young entrepreneurs and individuals. Registered businesses and unregistered businesses can easily open this account type.

Is my information secure when opening an account online?

The online account opening platform is 100% secured and your details are safe and secure. These details will be used only for the purpose for which they were collected.

How do I apply for a business loan?

Click on the Apply Now button, choose a category you fall under, fill in your details and click the box for ‘apply for a loan’, you will be directed to a loan portal to complete your request.

Other Opportunities

What opportunities for the program are available upon completing the training?

Graduates of the program have access to various financial support mechanisms, including loans, grants, and the possibility of being selected as a beneficiary of the Business Exchange program to the Netherlands/China/India.

Are employment opportunities also available for participants completing the training program?

Yes, the program connects participants with potential employers, fostering valuable networking opportunities and increasing their chances of securing meaningful employment in their chosen fields.

Is there ongoing support for program graduates beyond the initial training period?

Yes, graduates receive post-support through mentorship programs, networking events, and access to additional resources. This support aims to foster long-term success and sustainability in their chosen careers or entrepreneurial ventures.

Cryptocurrency5 days ago

Cryptocurrency5 days agoPixelverse Just Launched, and Millions Made, Dotcoin is about to Launch, Here is how to Join

Cryptocurrency5 days ago

Cryptocurrency5 days agoBinance’s Upcoming App Launch: Don’t Miss Out on This $10,000+ Airdrop

Recruitment14 hours ago

Recruitment14 hours agoLink to Apply for NNPC Recruitment 2024 – Follow this Guide to Register Successfully

Cryptocurrency4 days ago

Cryptocurrency4 days agoGet Rewarded Instantly: Renta Network Airdrop – Don’t Miss Out!

Nigeria News2 days ago

Nigeria News2 days agoTurn Clicks into Cash: Earn Up to $2 Daily with Nomis Score on Telegram – Start Now!

Cryptocurrency3 days ago

Cryptocurrency3 days agoLatest Airdrop Alert! Join Our Telegram Group and Make a Path to the Web3 Wealth

Cryptocurrency5 days ago

Cryptocurrency5 days agoCongratulations! You can Now Claim #DD Token, (You’re still Early if you are seeing this Post)

Recruitment13 hours ago

Recruitment13 hours agoHow to Successfully Apply for NNPC Recruitment Despite Website Traffic