Nigeria News

United States: Best Private Student Loans Of August 2021

Private student loans are created to help pay college tuition and other costs after

you’ve borrowed the maximum you qualify for in both subsidized and unsubsidized federal student loans.

Private student loans come from banks, credit unions and online lenders, and unlike federal student loans for undergraduates, they require a credit check. That means most undergrads will need a co-signer in order to qualify. Private student loans also are more expensive than federal loans—especially now that federal loan rates are at historic lows—and typically don’t offer the flexible repayment options their federal counterparts do.

TRENDING NOW

- United States Farm Storage Facility Loans Application 2021

- How to apply for Joe Biden’s student loan relief 2021

- Open Heaven 12th August 2021 RCCG Daily Devotional (Divine Healing)

- Apply for Abeg App And Get 500 Naira Bonus on Abeg App

- Apply Ghana Covid-19 Response Grant (CRG) Application 2021 (gea.gov.gh Portal)

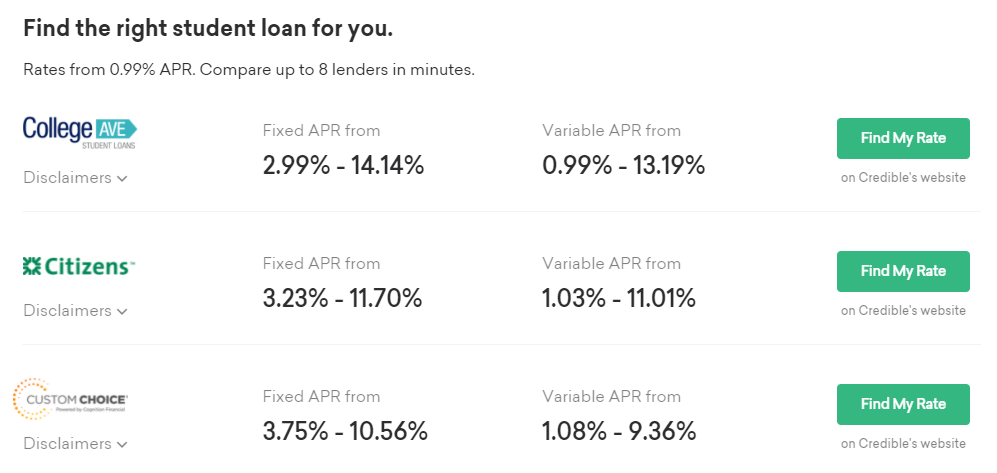

Use the table below to navigate to the desired loan company you wish to apply for.

Below is a list of the best student loans in the United States

Rhode Island Student Loan Authority Private Student Loans

Rhode Island Student Loan Authority, known as RISLA, is a nonprofit based in Rhode Island that lends to students across the country. It offers two different loan types for undergraduate students, which each come with their own fixed interest rates. One loan requires immediate repayment, and one lets you defer payments until six months after you leave school. Everyone who qualifies for each of the loan types gets the same rate, which makes it easy to compare RISLA loans with others you’ve qualified for.

For borrowers who struggle to afford their loan after graduating, RISLA is one of the only private lenders to offer an income-based repayment plan, which limits payments to 15% of income for a 25-year period.

Extra Details

Loan terms: 10 or 15 years

Loan amounts available: $1,500 to $45,000 per year ($150,000 aggregate per borrower)

Eligibility: Applicants must show a minimum income of $40,000 per year and a minimum credit score of 680. Most undergraduate students will need a co-signer to qualify.

Forbearance options: Forbearance is available for up to 24 months.

Co-signer release policy: Available after 24 months of payments. Periods during which borrowers use income-based repayment do not qualify.

Ascent Private Student Loans

Ascent offers both co-signed and non-co-signed student loans, which gives borrowers without co-signers more college funding options. We scored the company based on its co-signed credit-based student loan for undergraduates.

Ascent stands out for its range of payment reduction and postponement options, rare among private lenders. Borrowers can choose a graduated repayment plan, which provides a lower monthly payment to start that increases over time. That can be useful for graduates just starting out, who will likely make more money as they move up in their careers.

Borrowers also can pause payments if they’re experiencing a temporary financial hardship for one to three months at a time, up to a maximum of 24 months total. (Taking this forbearance means you will repay the loan over a longer period, though.) Interest continues to accrue during forbearance, which is true for the vast majority of private student loans.

Ascent also offers a graduation reward of 1% of the loan’s original principal balance. Check the conditions you must satisfy to qualify.

Extra Details

Loan terms: 5, 7, 10, 12 or 15 years

Loan amounts available: $2,001 up to the total cost of attendance, to a maximum of $200,000 per academic year ($200,000 aggregate)

Eligibility: Student borrowers with no credit history can qualify with a creditworthy co-signer. Co-signers must show income of at least $24,000 for the current and previous year. Co-signers must have a minimum credit score of 660 if the student has a score of less than 700, and a minimum credit score of 620 if the student has a score of 700 or higher.*

Forbearance options: When experiencing financial hardship, borrowers can suspend payments for up to three months at a time, for a total of up to 24 months throughout the loan term. Only four rounds of forbearance (up to 12 months’ worth) may be taken consecutively.

Co-signer release policy: Available after 24 months of consecutive automatic debit payments, if the primary borrower meets certain credit score requirements.

SoFi Private Student Loans

SoFi is perhaps best known as a student loan refinance lender, but it also makes loans to undergraduates, graduate students, law and business students and parents. Its undergraduate student loan product offers mostly industry-standard features, plus a few perks: no late fees, an interest rate discount of 0.125% if your co-signer already uses another SoFi product and job search help through its career team.

Extra Details

Loan terms: 5, 10 and 15 years

Loan amounts available: $5,000 to the total cost of attendance

Eligibility: Does not disclose credit score or income requirements

Forbearance options: SoFi offers a specific Unemployment Protection Program that allows borrowers to pause payments in three-month increments, for up to 12 months, if laid off from work. A separate forbearance program is also available for borrowers experiencing other types of economic hardship, such as medical expenses. Borrowers can take up to 12 months total forbearance, no matter which program they use.

Co-signer release policy: Available after 24 payments

A.M. Money Private Student Loans

Similar to Funding U, borrowers qualify for A.M. Money loans based on their educational background and GPA, not their credit. The company does not allow co-signers. A.M. Money also stands out for the fact that it offers an income-based repayment plan for up to 36 months for borrowers who need it. The minimum monthly payment on the plan is $50.

A.M. Money charges a 4.5% origination fee, and unpaid loans go into default sooner than most other lenders: 14 days, unless otherwise specified by state law.

Extra Details

Loan term: 10 years

Loan amounts available: $2,001 to total cost of attendance, up to a $50,000 cap

Eligibility: The loan is merit-based, so it has no credit or income requirements. Students must attend one of several eligible schools, mostly located in the Midwest. But A.M. Money encourages prospective borrowers to apply even if their school isn’t yet listed.

Forbearance options: Up to 12 months of forbearance available. Borrowers can make income-based payments for up to 36 months.

Co-signer release policy: No co-signer required

College Ave Private Student Loans

College Ave offers a solid all-around private loan product with a few unique features. Borrowers can choose an eight-year term, which is in addition to the typical five-, 10- and 15-year terms many lenders provide. Borrowers can also access an extended six-month grace period beyond the initial payment-free six months allowed after separating from school.

Extra Details

Loan terms: 5, 8, 10 and 15 years

Loan amounts available: $1,000 up to the total cost of attendance

Eligibility: Applicants must have a minimum credit score in the mid-600s.

Forbearance options: Up to 12 months of forbearance is available, in three- to six-month increments

Co-signer release policy: Available after 24 payments

Funding U Private Student Loans

While Funding U’s rates are higher than other private lenders, the company is unique in that it doesn’t make loans based on credit history and it doesn’t require student borrowers to use a co-signer. Borrowers qualify for a loan based on academic and work background, current courses, graduation prospects and likely future earnings.

Also, while Funding U’s loan limits are comparatively low, private loans should be used sparingly, so ideally borrowers won’t need them to finance larger gaps in funding.

Extra Details

Loan term: 10 years

Loan amounts available: $3,000 to $10,000 per year ($50,000 per student aggregate)

Eligibility: Students must meet GPA requirements and attend colleges that meet certain six-year graduation rate thresholds, depending on the student’s year in school. To qualify, first-year students must have a minimum high school GPA of 3.5, second-year students must have a minimum college GPA of 3.0, juniors must have a minimum GPA of 2.75 and seniors must have a minimum GPA of 2.5.

Note that only borrowers in these states can apply: Arizona, Arkansas, Colorado, Connecticut, Florida, Georgia, Hawaii, Illinois, Indiana, Kansas, Maryland, Massachusetts, Michigan, Missouri, Nebraska, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, Vermont, Virginia, West Virginia and Wisconsin.

Forbearance options: Up to 24 months of forbearance allowed in 90-day increments. Borrowers must pay $30 per month while in forbearance, which is less generous than payment-free forbearance that other lenders offer. But this policy helps borrowers avoid occurring large amounts of interest.

Co-signer release policy: No co-signer required

Discover Private Student Loans

Discover charges no late fees on its private student loans, and it provides an interest rate discount if borrowers choose to pay the interest on the loan as it accrues while they’re in school. It also offers several unique deferment, forbearance and hardship payment options.

Co-signer release is not available, though, and there is only one loan term: 15 years. Know that you can prepay the loan without penalty, and if you have the means to do so, paying off a student loan in less than 15 years could save you a substantial amount in interest.

Extra Details

Loan term: 15 years

Loan amounts available: $1,000 up to total cost of attendance

Eligibility: Discover does not disclose its minimum credit score or income requirements, but in 2019 the company reported that 94% of all private loan borrowers had a FICO score of 660 or higher.

Forbearance options: Borrowers can take up to 12 months of forbearance, which is standard across the industry. But Discover also offers several additional hardship options, including a three-month suspension of payments for borrowers early in the repayment cycle and a six-month reduced payment option.

Co-signer release policy: None.

PNC Bank Private Student Loans

PNC Bank offers an extra-generous 0.50% interest rate discount for making automatic payments, and it provides a 12-month loan modification program for borrowers in financial distress (in addition to 12 months of forbearance). Loan modification lowers the interest rate and monthly payment charged.

It also offers co-signer release, though after an even longer period than Citizens Bank’s policy: 48 months.

Extra Details

Loan terms: 5, 10 and 15 years

Loan amounts available: Up to $50,000 per year ($225,000 aggregate, including federal student loans)

Eligibility: Does not disclose credit score or income requirements.

Forbearance options: Up to 12 months of forbearance available.

Co-signer release policy: Co-signers can be released from the loan after 48 payments.

Citizens Bank Private Student Loans

Citizens Bank provides an additional 0.25% loyalty discount if a student loan borrower or their co-signer has an existing account with the bank. (Checking and savings accounts are only available in Connecticut, Delaware, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Pennsylvania, Rhode Island and Vermont.)

It also makes its loans available to international students. But co-signers must wait a longer period of time to be released from the loan than what many other lenders provide.

Extra Details

Loan terms: 5, 10 and 15 years

Loan amounts available: $1,000 up to $150,000 total over the course of your undergraduate education

Eligibility: Does not disclose credit score or income requirements.

Forbearance options: Up to 12 months of forbearance available.

Co-signer release policy: Co-signers can be released from the loan after 36 payments.

Source: https://www.forbes.com/advisor/student-loans/best-private-student-loans/