Business

Apply for Ongoing CBN Creative Industry Loan for 2022

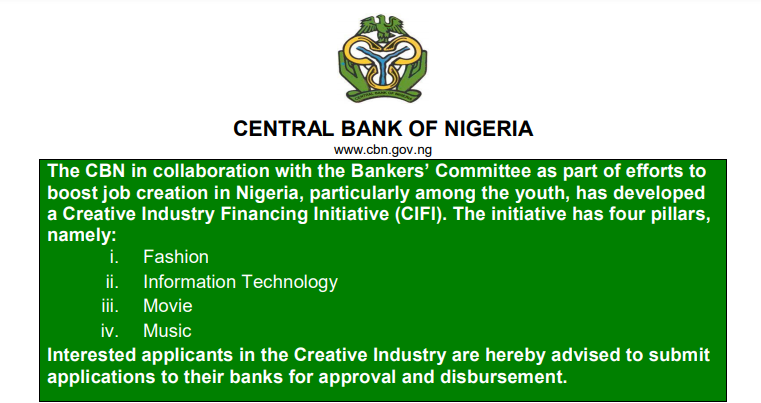

CBN Creative Industry Loan 2022: As part of its Creative Industry Financing Initiative (CIFI), the CBN will disburse loans at a 9% interest rate through Nigerian banks to creative businesses which satisfy the eligibility requirements. The CIFI loan has a flexible repayment period spanning 3 to 10 years.

Learn more on the official website via https://www.cbn.gov.ng

TRENDING NOW on searchngr.com

- Open Heaven 7th July 2021 RCCG Daily Devotional (Watch The Company You Keep)

- How to Apply for UK Travel Health Certificate (Public Passenger Locator Form)

- How to Apply for Ongoing Nirsal Microfinance Bank Loan 2021

- Borno State Scholarship Board, For Indigenes Across the Country

- PTDF Scholarship 2021/2022, For Undergraduate, Masters, and PhD

The Central Bank of Nigeria (CBN) introduced loans to support creative industries in Nigeria.

It’s in the industry that we have art and craft and other creative works!

Eligibility for CBN Creative Industry Loan 2022

To qualify for the CIFI loan, applicants should operate businesses in any of these areas: Fashion, Information Technology, Movie Production, Movie Distribution, and Music distribution. Loans are available for Software Engineering students as well.

Businesses must be duly registered with the Corporate Affairs Commission, possess a valid Bank Verification Number BVN, and prepare a comprehensive business plan.

It is accurately observed that funds like the loan is not readily available for this creative-oriented category of individuals. Financing your business as a creative individual is not really encouraging because financial institutions rarely give loans to them but prefer to give loans to develop organizations or steady income receiving individuals.

Amount of Loan you can Access for Business

You can get a loan of up to:

- N3 million for Software Engineering Student

- N30 million for Movie Production business

- N500 million for Movie Distribution business

- Cover your rental/service fees for Fashion and Information

- Technology business

- Cover your training fees, equipment fees, and rental/service fees for the Music business

How to apply for CBN Creative Industry Loan 2021

The only way to apply for CBN Creative Loan is through your local bank. Walk up to your designated bank and request that you want to apply for CBN Creative Industry Loan. Your bank will discuss your request and plan for your loan disbursement.

Period for the repayment of the loan

- For Software Engineering Student Loan, it is a maximum of three years

- For Movie Production and Distribution, it is a maximum of ten years

- For Fashion, Information Technology (IT) and Music, it is a maximum of ten years

For more information, please visit: www.cbn.gov.ng

Deadline: There is currently no deadline for this application.

Cryptocurrency5 days ago

Cryptocurrency5 days agoPixelverse Just Launched, and Millions Made, Dotcoin is about to Launch, Here is how to Join

Cryptocurrency5 days ago

Cryptocurrency5 days agoBinance’s Upcoming App Launch: Don’t Miss Out on This $10,000+ Airdrop

Recruitment13 hours ago

Recruitment13 hours agoLink to Apply for NNPC Recruitment 2024 – Follow this Guide to Register Successfully

Cryptocurrency4 days ago

Cryptocurrency4 days agoGet Rewarded Instantly: Renta Network Airdrop – Don’t Miss Out!

Nigeria News2 days ago

Nigeria News2 days agoTurn Clicks into Cash: Earn Up to $2 Daily with Nomis Score on Telegram – Start Now!

Cryptocurrency3 days ago

Cryptocurrency3 days agoLatest Airdrop Alert! Join Our Telegram Group and Make a Path to the Web3 Wealth

Cryptocurrency5 days ago

Cryptocurrency5 days agoCongratulations! You can Now Claim #DD Token, (You’re still Early if you are seeing this Post)

Recruitment13 hours ago

Recruitment13 hours agoHow to Successfully Apply for NNPC Recruitment Despite Website Traffic

Aganyi Jamesmary Omashi

Tuesday, 28 December 2021, 6:35 at 6:35 pm

OK , I am waiting.

Aganyi Jamesmary Omashi

Tuesday, 28 December 2021, 6:31 at 6:31 pm

Please, I will like to get feedback. To know My stand.

This coming New year. I expect success, and not to continue starving.

Thanks

Aganyi Jamesmary Omashi

Tuesday, 28 December 2021, 6:24 at 6:24 pm

Good day all assistance scheme. I don’t even know you are already with my information and details.

Please I want to start business instantly and my account is empty.

Please make it easier for me.

Is been so frustrating.

Thanks,

yours friend Jamesmary